EUR

en

OEM FGD pump suppliers are predominantly concentrated in key industrial regions known for their robust manufacturing ecosystems and specialized supply chains. China stands as a major hub, with significant clusters in provinces like Fujian, Zhejiang, Jiangsu, Shandong, and Guangdong, alongside major metropolitan areas such as Shanghai. These regions benefit from established infrastructure, access to skilled labor, and mature networks for raw materials and component sourcing, creating favorable conditions for pump manufacturing.

Fujian province, for instance, hosts several manufacturers and suppliers specializing in fluid handling equipment, leveraging its proximity to ports for efficient export logistics. Zhejiang and Jiangsu boast extensive industrial zones with companies excelling in precision engineering and large-scale production capabilities. Shanghai, as a global trade center, offers suppliers with strong international logistics support and often acts as a gateway for foreign businesses. The advantage of sourcing from these clusters includes competitive pricing due to economies of scale, shorter lead times for regional buyers, and access to suppliers with diverse specializations, from high-volume manufacturers to niche custom solution providers. These regional strengths make them prime locations for identifying reliable OEM partners for FGD systems.

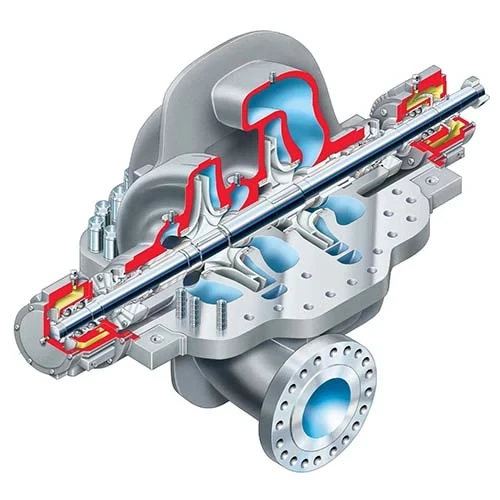

Selecting the right OEM FGD pump supplier requires evaluating critical criteria beyond basic pricing. Technical expertise and adherence to industry standards are paramount. Suppliers should demonstrate proficiency in handling the corrosive and abrasive slurries typical in flue gas desulfurization applications. Key selection factors include the pump's material compatibility (e.g., alloy suitability for specific FGD chemistries), design robustness for continuous operation, and compliance with relevant standards such as ISO 5199, ANSI/HI, or specific environmental regulations.

Verifying quality and reliability involves scrutinizing supplier credentials. Look for manufacturers holding certifications like ISO 9001 for quality management systems. Assess their manufacturing capabilities through documented processes, in-house testing facilities (e.g., for performance curves and NPSHr), and quality control protocols. Reviewing performance metrics is essential; examine data on on-time delivery rates, average response times to inquiries, and customer reorder rates, as these indicate operational efficiency and client satisfaction. Requesting factory audits or detailed production process documentation provides tangible evidence of their capability to deliver pumps that meet the demanding requirements of FGD systems reliably over their operational lifespan.

Evaluating top OEM FGD pump suppliers involves comparing key operational and service metrics. The table below presents a snapshot based on available data points:

Analysis reveals distinct profiles. Large-scale manufacturers like Godo Manufacturing (Zhejiang) and Jiangsu Chanqi Technology offer significant factory footprints and high online revenue, suggesting substantial production capacity and market presence, though response times may be longer. Suppliers like Fujian Forwater and Jiangsu Chanqi boast perfect on-time delivery and rapid response times (≤1h-≤2h), ideal for time-sensitive projects. Established entities such as Shanghai Mac-Beyond Machinery (11 years) combine longevity with strong delivery performance. High reorder rates, seen with Godo (35%) and Quanzhou Nuoyi (37%), often signal strong customer satisfaction and product reliability. Buyers prioritizing scale might lean towards large manufacturers, while those needing agility might consider responsive suppliers or mid-sized manufacturers like Dongguan Suncenter, which balances solid delivery, response time, and factory size.

Verification involves checking material certifications for alloys used (e.g., ASTM reports), reviewing factory audit reports (like ISO 9001), requesting performance test data specific to FGD slurry conditions, and examining documented quality control processes during manufacturing, including non-destructive testing (NDT) methods.

Production lead times vary significantly based on pump complexity and customization. Standard models might take 4-8 weeks, while highly customized units could require 10-16 weeks. Sample production typically takes 2-6 weeks, depending on the supplier's workload and the complexity of the sample requested.

Sample policies differ. Some suppliers, particularly manufacturers with larger operations or those keen on new business, may offer free samples, though shipping costs often fall to the buyer. Others charge a nominal fee for the sample itself. It's essential to clarify sample terms directly with the supplier.

Reputable manufacturers often welcome qualified buyers for factory visits to demonstrate capabilities and build trust. Scheduling meetings, either virtually or in person, is common practice. Suppliers like Godo Manufacturing or Fujian Forwater, with substantial facilities, typically accommodate such requests as part of their sales process.

Yes, most established OEM FGD pump suppliers based in major manufacturing hubs like China have extensive experience in international logistics and export documentation. They routinely ship pumps worldwide to power plants and industrial facilities, handling customs clearance for various regions.

Bookmark

Daniel Féau processes personal data in order to optimise communication with our sales leads, our future clients and our established clients.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.