EUR

en

The global market for self-priming slurry pumps continues to expand steadily, driven by increasing demand from mining, construction, wastewater treatment, and dredging industries. Current market size estimates place the industry at approximately $2.8 billion annually, with projections indicating a compound annual growth rate (CAGR) of 5.7% through 2028. This growth trajectory stems largely from infrastructure development projects worldwide and stricter environmental regulations requiring efficient slurry handling solutions.

Key industry trends include the integration of IoT technology for real-time performance monitoring and predictive maintenance capabilities. Manufacturers are increasingly focusing on developing energy-efficient models to reduce operational costs, with some newer units achieving up to 15% better energy efficiency than previous generations. Material science advancements have led to more durable impellers and casings capable of handling highly abrasive slurries for extended service life.

Major market drivers include rapid urbanization in developing nations, increased mineral extraction activities, and growing investments in water infrastructure. Challenges persist in the form of high maintenance costs for improperly selected units and the technical difficulty of handling slurries with varying solid concentrations and particle sizes. The complexity of sealing technology for preventing leakage during continuous operation remains an engineering focus area.

Regionally, Asia-Pacific dominates market share with over 45% of global demand, primarily fueled by China's extensive infrastructure projects and mining operations. North America and Europe follow with significant shares, driven by wastewater treatment upgrades and mining operations. Emerging economies in Africa and South America present growth opportunities as mineral extraction activities increase.

Technological advancements are reshaping pump capabilities. Computational fluid dynamics (CFD) has enabled optimized hydraulic designs that reduce cavitation risks. Smart pump systems now incorporate sensors that monitor vibration, temperature, and pressure to predict component failures before they cause downtime. These innovations directly impact operational efficiency and total cost of ownership calculations for industrial buyers.

Selecting the appropriate self-priming slurry pump requires careful evaluation of multiple technical parameters to ensure optimal performance in specific applications. Begin by analyzing slurry characteristics including particle size distribution, solids concentration, specific gravity, and abrasiveness. These factors determine required wear resistance levels and impeller design specifications. The pump's material composition must align with slurry chemistry to prevent premature corrosion - hardened cast iron, chrome alloys, or rubber-lined components serve different chemical environments.

Industry compliance requirements vary significantly based on application. Mining operations often require MSHA-certified equipment, while wastewater treatment facilities need pumps meeting ANSI/ISO 5199 standards. Food processing applications demand FDA-compliant materials. Verify necessary certifications for your specific industry before procurement.

Performance metrics should be scrutinized beyond basic flow rate and head specifications. Examine curve stability across various operating points and evaluate suction lift capabilities under different solids-loading conditions. Best practice involves requesting certified pump performance curves from manufacturers showing actual test data rather than theoretical values.

Cost-efficiency extends beyond initial purchase price. Calculate total lifecycle costs including energy consumption, expected maintenance intervals, spare parts availability, and projected mean time between failures. Pumps with slightly higher upfront costs but superior efficiency and durability often deliver better long-term value. Evaluate maintenance accessibility - designs allowing component replacement without full disassembly reduce downtime expenses.

Quality assurance considerations include requesting material certifications, factory test reports, and warranty terms. Reputable manufacturers typically provide documented performance testing before shipment. Request evidence of quality management systems such as ISO 9001 certification.

Integration capabilities with existing control systems deserve attention. Determine required communication protocols (Modbus, Profibus, etc.) for supervisory control and data acquisition (SCADA) integration. Verify physical connection compatibility with existing piping systems to avoid costly modifications.

After-sales support evaluation should encompass spare parts availability, technical support responsiveness, and service network coverage. Suppliers with regional service centers and comprehensive parts inventories typically minimize operational disruptions. Inquire about mean repair turnaround times and availability of technical documentation.

When evaluating self-priming slurry pumps for industrial applications, several models stand out based on technical specifications, reliability metrics, and industry feedback. The following comparison highlights key performance indicators:

| Product Name | Review Score | Minimum MOQ | Price Range | Buyer Record Rate | Delivery Type | | --- | --- | --- | --- | --- | --- | | HTLB Self Priming Sludge Delivery Lobed Rotor Heavy Slurry Pump | 5.0 | 1 piece | $1,200 | 17% | Manufacturer | | High Pressure Non Clog Self Priming Slurry Trash Water Pump | 5.0 | 1 set | $1,200 | 11% | Supplier | | Non-block Solid Handling Self-priming Trash Sewage Liquid Transfer Slurry Pump | 4.9 | 5 pieces | $795-800 | 27% | Manufacturer | | Self Priming Sludge Slurry Transfer Cutter Mining Water Pumps | 5.0 | 1 set | $1,769 | 18% | Manufacturer | | Horizontal Acid and Alkali Resistant Self-pumping Slurry Pump | N/A | 1 set | $988 | N/A | Manufacturer |

Analysis reveals distinct application strengths among top models. The HTLB Lobed Rotor pump excels in handling high-viscosity sludges with large solids, featuring robust construction capable of sustained heavy-duty operation. Its fixed price structure simplifies procurement budgeting. The Non-block Solid Handling unit offers excellent value for medium-duty applications with its tiered pricing and 27% buyer repeat rate indicating strong customer satisfaction. For mining applications requiring cutter capabilities, the Slurry Transfer Cutter model provides specialized solids reduction functionality, though at a premium price point.

Industrial buyers should note significant differences in buyer record rates (repeat purchase indicators) ranging from 11% to 27%. Units with higher rates typically demonstrate better long-term reliability and lower total cost of ownership. Minimum order quantities vary from single units to five pieces, affecting procurement flexibility. Material specifications differ substantially - while most employ hardened alloys, the acid-resistant model incorporates specialized composites for chemical applications.

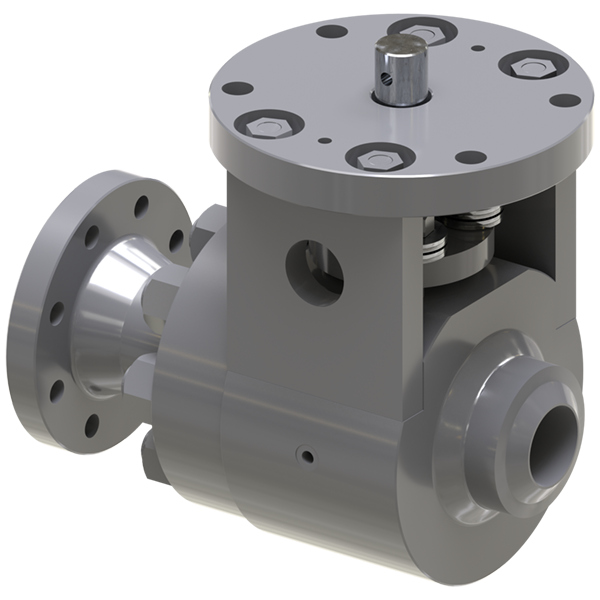

Self-priming capability in slurry pumps is achieved through specialized casing designs that create a vacuum during initial startup. This vacuum allows the pump to evacuate air from suction lines and draw liquid upward without external priming equipment. The mechanism typically involves an internal reservoir that retains fluid after shutdown, creating the necessary seal for subsequent startups.

These pumps incorporate several design features to manage abrasives. Hardened alloy components (typically chromium oxide or similar wear-resistant materials) protect critical wear surfaces. Hydraulic designs optimize flow velocity to minimize particle impact on vulnerable areas. Some models feature replaceable wear plates and impellers designed for quick maintenance. Optimal clearance tolerances balance efficiency with solids-passing capability.

Maintenance requirements vary by operating conditions, but industrial slurry pumps generally require inspection every 500-800 operating hours. Full service intervals typically range from 2,000-4,000 hours. Critical wear components like impellers, liners, and seals may need replacement within this timeframe depending on slurry abrasiveness. Monitoring vibration and performance degradation provides the best indicator for specific maintenance needs.

Modern designs accommodate concentration fluctuations through adaptive impeller designs and wear-resistant components. However, significant concentration changes (below 5% or above 40% solids by weight) may require operational adjustments. Pumps with variable frequency drives can maintain performance across varying densities by adjusting rotational speed to compensate for changing hydraulic conditions.

Mechanical seals remain standard, with tungsten carbide/carbon pairings offering good performance in most applications. For extremely abrasive slurries, expeller seal systems that create a clean fluid barrier provide enhanced protection. Some heavy-duty applications utilize double seals with flush systems. Seal selection depends on particle size, temperature, and chemical compatibility requirements.

Material choice directly affects abrasion resistance and service life. Hardened white iron (500-600 BHN) offers excellent wear resistance for most mineral slurries. For highly corrosive chemical slurries, duplex stainless steels or specialized elastomers may be required. Mining applications often specify extra-thick abrasion-resistant materials in critical wear zones to extend component life.

Bookmark

Daniel Féau processes personal data in order to optimise communication with our sales leads, our future clients and our established clients.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.