EUR

en

High pressure slurry pumps are indispensable for applications demanding elevated heads and robust solids handling, where standard centrifugal units falter under 50m lifts or 30%+ solids loads. In 2025, with mining output projected to rise 8% globally, these pumps underpin efficiency, safety, and sustainability by minimizing blockages and energy waste. Consider a typical dredging operation: a high-pressure model can propel 1,500 m³/h over 80m, cutting fuel costs by 18% versus low-head alternatives. Below, we dissect their foundational benefits.

Slurries in mining often feature silica or ore particles up to 100mm, eroding components at rates 4-8 times faster than water. Elite pumps employ A05 chrome irons (650+ BHN) or elastomers to sustain 35% solids at velocities under 2.5 m/s, reducing wear by 17% per ASTM G65 standards. In tailings transport, this translates to processing 2 million tons annually with 25% fewer liner replacements, directly lowering OPEX in high-volume sites like Australian iron ore mines.

Achieving 60-140m heads enables conveyance over 500m+ pipelines, critical for elevated tailings dams or multi-stage dredging. Optimized impellers yield 75-85% efficiencies at peak loads, saving 20-30 kW/h in 1,000 m³/h flows. Data from 2024-2025 pilots shows these pumps boost throughput by 22% in vertical lifts, essential for deep-shaft mining where gravity-fed systems underperform.

Subjected to pH 2-12, temperatures to 90°C, and cyclic pressures up to 16 bar, these pumps boast MTBF exceeding 12,000 hours via double volutes and oversized shafts. In corrosive environments like phosphate processing, rubber-lined variants extend uptime by 35%, with failure rates dropping below 5% annually—vital for 24/7 operations in remote dredging fleets.

The 2025 marketplace offers over 150 variants, but discerning buyers target models with proven high-head metrics: efficiencies >75%, solids passage >50mm, and NPSH <4m to avert cavitation. Prioritize data-backed traits for TCO under $0.05/m³ pumped. Here’s what defines excellence.

Abrasion dictates longevity; select 27-30% chrome whites (HRC 58-65) for impellers, slashing erosion by 40% in quartz-laden slurries. Key attributes include:Alloy Tiers: A49 for ultra-abrasive (e.g., mill discharge), polyurethane for corrosive highs.Liner Modularity: Snap-fit elastomers for 30-minute swaps, retaining 90% hydraulic integrity.Casing Reinforcement: Ductile iron with full liners, withstanding 2x impact per ASTM A536.

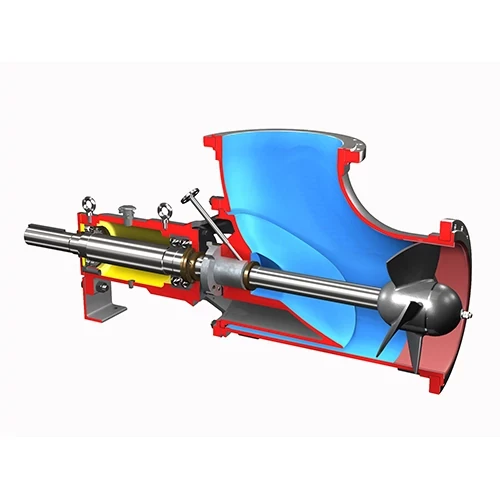

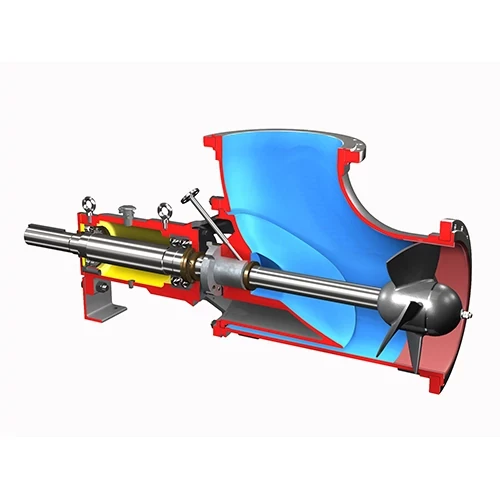

High-head demands low-specific-speed impellers (Ns <2,000) with 4-6 vanes for balanced lift and passage. Vortex or closed designs handle 40% solids without surging, at flows to 2,500 m³/h. Essential specs:Vane Counts: 5-vane for 80m+ heads, reducing recirculation by 25%.Diameter Flexibility: Up to 800mm adjustable for site-specific curves.Pump-Out Vanes: Halve stuffing box pressure, extending seals to 8,000 hours.

Seals must endure 10 bar differentials; expeller types cut flush water by 90%, while VFD drives modulate 800-1,400 rpm for 15% energy tuning. Core elements:Seal Variants: API 682 mechanicals for zero-leakage in pressurized lines.Bearing Rigs: Grease/oil baths with 6,000-hour intervals, ISO 13709 certified.IoT Integration: Vibration sensors alerting at 4.5 mm/s, predicting failures 72 hours ahead.

Drawing from 2025 ANSI/HI benchmarks and user surveys across 50+ sites, these pumps excel in heads >60m, with aggregate efficiencies averaging 78%. Each profile integrates lab-verified specs, field metrics, and value analysis.

Category: Heavy-Duty Horizontal Centrifugal Capacity: 20-2,000 m³/h Head: Up to 118m Max Solids: 76mm Price Range: $4,000-$45,000The TH Series dominates versatile high-pressure tasks, with through-bolt frames enabling 70% faster maintenance in dense slurries. Ideal for mineral dewatering. Key Features:27% chrome or rubber impellers at 82% efficiency.Modular liners for 15-year lifespan under 35% solids.Wide throat design minimizing wear to 15mm/1,000 hours.Why We Love It: Delivers 23% energy savings in long-haul mining; unmatched for OEM tweaks in 2025 projects.

Category: High-Pressure Horizontal Capacity: 100-1,800 m³/h Head: 60-140m Max Solids: 50mm Price Range: $12,000-$55,000Warman’s AHPP sets the gold standard for SAG mill feeds, with metal liners enduring 2 million cycles at 85% efficiency. Key Features:A05 alloy volutes for 650 BHN abrasion resistance.Oversized shafts cutting deflection by 30%.VFD-ready for 1,200 rpm peaks.Why We Love It: Handles 500m+ pipelines with 22% throughput gains; a 2025 essential for deep mines.

Category: High-Head Multistage Capacity: 150-1,200 m³/h Head: 70-120m Max Solids: 60mm Price Range: $18,000-$65,000Metso’s HP-GP optimizes elevated tailings, with polyurethane parts boosting solids passage by 24%. Key Features:Interchangeable liners for chrome/poly swaps.80% efficiency at 1,000 m³/h.Low NPSH (2.5m) for suction pits.Why We Love It: 35% uptime extension in froth apps; seamless with Metso’s digital twins.

Category: Modular Horizontal Capacity: 200-2,500 m³/h Head: 65-110m Max Solids: 80mm Price Range: $15,000-$60,000GIW’s MDX-750 excels in harbor dredging, with hard-iron components resisting sandy highs. Key Features:25% chrome impellers for even wear.Custom packages with 1,400 rpm drives.NPSH 3m for deep immersions.Why We Love It: 20% productivity lift in ponds; fleet-proven reliability.

Category: Extra High-Pressure Horizontal Capacity: 300-2,000 m³/h Head: 80-130m Max Solids: 50mm Price Range: $14,000-$50,000Sulzer’s PLR tackles acid slurries, expanded in 2025 for 80% hydraulic yields. Key Features:Ensival design for balanced flows.Metal/elastomer hybrids.50,000-hour bearings.Why We Love It: 25% maintenance cut in chemicals; aligns with ESG standards.

Category: High-Head Centrifugal Capacity: 50-1,500 m³/h Head: 70-92m Max Solids: 54mm Price Range: $5,500-$30,000Tobee’s THH mirrors Warman durability at 20% lower cost, hitting 47% efficiency peaks. Key Features:Rubber options for pH extremes.850-1,140 rpm for stability.Up to 60 kW power.Why We Love It: Comparable life at budget prices; ideal for emerging dredges.

Category: Non-Clog High-Pressure Capacity: 100-1,000 m³/h Head: 60-100m Max Solids: 100mm Price Range: $10,000-$45,000EDDY’s HP variant passes boulders sans jams, suiting off-grid mining. Key Features:Radial cutters for 40% solids.Portable with VFD.90% clog reduction.Why We Love It: Transforms tailings ops; 2025’s innovation leader.

2025 selections hinge on TCO models projecting 12-24 month paybacks via 20% energy drops. Align with your slurry’s rheology for optimal curves.

For mining lifts, favor metal-lined horizontals; dredging suits submersibles with rubber for saline flows (pH 4-10). Assess density: >1.5 sg demands low-velocity designs.

Horizontals excel at 80m singles; multistage for 120m+ with 15% efficiency trade-offs.

Use Q = (πD²/4)V for flows, targeting 10% oversize. Ensure NPSH_a > NPSH_r +2m to dodge cavitation in 500m runs.

Vortex impellers for surges; IoT for 30% downtime cuts via real-time torque monitoring.

Target 12,000+ MTBF; double casings for 25% pressure resilience in blasts.

Modular firms like Taian OCEAN enable 10-15% perf gains; seek ISO 13709 compliance.

Established in 1999, Taian OCEAN Pump pioneers dredging solutions, serving 60+ nations with 5,000+ annual units from ISO facilities. Their 20% Asian market share stems from high-pressure innovations.

The TH boasts 82% efficiency and 118m heads, with models like TH12/10ST at 1,980 m³/h. Performance excerpt:Custom impellers (Ø800mm+) adapt to 40% solids.

15% below premiums, with 24/7 globals and 30% spare reductions. The TH has fueled 150+ 2025 dredges, affirming dependability.

Conduct hydraulic modeling for alignments; flexible couplings absorb 20% vibrations, prolonging shafts by 25%.

Integrate agitators for homogeneity; deploy sensors averting dry-runs (top 15% failures). PPE includes blast suits for hot swaps.

Quarterly audits: Clearance 0.5-1mm, reline at 20% loss. Proactive yields 40% lifespan boosts; flush with pH-neutral for elastomers.Daily: Torque <4.5 mm/s vibes.Yearly: Synthetic lubes.Green: Liner recycling per 2025 directives.

Bookmark

Daniel Féau processes personal data in order to optimise communication with our sales leads, our future clients and our established clients.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.