EUR

en

Industrial pumps are the backbone of fluid dynamics across sectors, engineered to handle diverse media—from clean water in municipal systems to viscous slurries laden with 50% solids in mining. In 2025, the sector’s evolution is marked by digital twins for 25% faster prototyping, variable frequency drives (VFDs) boosting efficiency to 85%, and eco-materials reducing carbon footprints by 20% (Blackridge Research, 2025). Global leaders invest USD 2–5 billion annually in R&D, yielding pumps with heads up to 300 meters, pressures to 100 bar, and MTBF (mean time between failures) exceeding 10,000 hours.

Why focus on top manufacturers? Reliability data shows elite brands cut maintenance costs by 15–25%, with 98% uptime in harsh environments like offshore oil rigs or tailings ponds. From centrifugal pumps dominating 60% market share (flow rates 100–10,000 m³/h) to positive displacement variants for precise metering (0.1–500 m³/h), these companies address pain points like cavitation (mitigated via CFD-optimized impellers) and abrasion (via Hardox 500 linings). As sustainability mandates intensify—e.g., EU’s 2030 energy efficiency directive—these firms lead with low-NPSH designs and recycled alloys.

This curated list emphasizes diversity: European precision (e.g., Sulzer’s Swiss engineering), American ruggedness (Flowserve’s Texas heritage), and Asian innovation (OCEAN Pump’s dredging expertise). Each profile equips you with specs like impeller diameters (200–1,000 mm), motor powers (5–2,000 kW), and application ROI (e.g., 20% throughput gains). Whether scaling for a 1,000 m³/h wastewater plant or customizing for 60% solids slurry, these insights—backed by 2025 case studies—illuminate paths to optimal selection. Don’t miss our centrifugal vs. positive displacement comparison for deeper dives.

Flowserve Corporation, headquartered in Irving, Texas, USA, stands as a titan in the global industrial pump arena, with roots tracing back to 1997 through mergers of legacy firms like Worthington Pump (founded 1840). As a Fortune 500 entity, Flowserve commands a 12% market share in flow control solutions, producing over 1 million pumps annually across 50+ manufacturing sites worldwide (Flowserve Annual Report, 2025). Renowned for precision engineering, the company invests USD 150 million yearly in R&D, focusing on digital pump twins that predict failures with 95% accuracy via AI analytics. Flowserve’s pumps excel in high-stakes environments, boasting 99% reliability in API 610-compliant designs for oil and gas, where they handle temperatures from -50°C to 400°C and pressures up to 250 bar.

Flowserve’s portfolio spans centrifugal, positive displacement, and specialty pumps, serving petrochemicals (40% revenue), power generation (25%), and water management (20%). Their global service network—spanning 200 locations—ensures 48-hour response times, slashing downtime by 30% for clients like ExxonMobil. In 2025, Flowserve’s sustainability push includes 40% recycled content in casings, aligning with ISO 14001 standards and reducing lifecycle emissions by 18%.

Centrifugal Pumps (e.g., Mark III Series):Single-stage overhung designs with impeller diameters 200–600 mm, flow rates 50–5,000 m³/h, heads 10–200 m; efficiency 80–90%; ideal for hydrocarbon transfer, with mechanical seals rated to 100 bar.

Positive Displacement Pumps (e.g., DP Series):Reciprocating piston models for viscous fluids (up to 1,000 cSt), capacities 0.5–300 m³/h, pressures 10–400 bar; shear-sensitive handling for polymers, with API 674 compliance.

Slurry and Solids-Handling Pumps (e.g., Mark V Series):Hard-metal lined for 40% solids, flow 100–2,000 m³/h, abrasion resistance via Cr27 alloys; used in tailings (MTBF 8,000 hours).

Vertical Turbine Pumps (e.g., HPX Series):For deep-well applications, heads up to 300 m, efficiencies 85–92%; NSF/ANSI 61 certified for potable water.

Flowserve’s edge lies in modular designs, enabling 20% faster installations and 15% energy savings via VFD integration. A 2025 case in Saudi Aramco’s refineries demonstrated 25% reduced OPEX through predictive maintenance, underscoring their USD 4.5 billion revenue prowess.

Sulzer Ltd., a Swiss engineering powerhouse founded in 1834 in Winterthur, Switzerland, epitomizes European precision in industrial pumps, holding an 8% global share with annual production exceeding 500,000 units (Sulzer Sustainability Report, 2025). With 14,000 employees across 180 locations, Sulzer’s CHF 3.5 billion (USD 4 billion) revenue fuels innovations like SALOMAX axial split-case pumps, which achieve 92% efficiency—10% above industry averages—through CFD-optimized hydraulics. Specializing in rotating equipment, Sulzer serves chemicals (35%), oil and gas (30%), and pulp/paper (15%), with pumps enduring pH 1–14 media and solids up to 20%.

Sulzer’s commitment to decarbonization shines in 2025, with 50% renewable energy in operations and pumps featuring low-NPSH impellers (under 2 m) for cavitation-free runs. Their global service hubs provide 24/7 monitoring, yielding 98% uptime for clients like BASF.

Process Pumps (e.g., SME Series):Multistage centrifugal for high-pressure (up to 150 bar), flow 10–3,000 m³/h, impeller sizes 150–400 mm; API 610/682 compliant for refineries.

Slurry Pumps (e.g., MS Series):Metal-lined for 50% solids, capacities 200–4,000 m³/h, heads 20–80 m; Hardox 500 wear plates extend life 25%.

Magnetic Drive Pumps (e.g., ZM Series):Seal-less for hazardous fluids, flow 1–500 m³/h, temperatures -50°C to 350°C; ATEX certified for explosive atmospheres.

Vertical Pumps (e.g., VTP Series):For sump applications, heads 5–150 m, efficiencies 85–90%; self-priming variants for flood control.

Sulzer’s 2025 highlight: A pulp mill deployment in Finland cut energy use 22% with VFD-integrated pumps, generating USD 1.2 million annual savings—exemplifying their legacy of reliability.

KSB SE & Co. KGaA, established in 1871 in Frankenthal, Germany, is a family-owned juggernaut with a 7% market stake, manufacturing 1.5 million pumps yearly across 60 subsidiaries (KSB Annual Report, 2025). Employing 15,500 globally, KSB’s EUR 2.8 billion (USD 3.1 billion) turnover underscores expertise in valves and automation, with R&D (EUR 100 million/year) yielding Amarex submersibles that handle 15% solids at 92% efficiency. Dominant in water/wastewater (40%), energy (25%), and industry (20%), KSB’s pumps operate at heads 10–250 m and flows 1–10,000 m³/h.

KSB’s ISO 50001 energy management certification drives 2025’s green initiatives, including 30% recycled steel in casings. Their PumpDrive systems integrate VFDs for 20% power savings, serving icons like Siemens.

Centrifugal Pumps (e.g., Etanorm Series):Horizontal end-suction, flow 5–2,000 m³/h, heads 5–100 m; efficiencies 85–90%; DIN/EN compliant for building services.

Submersible Pumps (e.g., UPA Series):For sewage, capacities 10–500 l/s, solids passage 50–100 mm; explosion-proof (ATEX Zone 1).

Multistage Pumps (e.g., Movitec Series):Vertical inline, pressures to 160 bar, flow 1–50 m³/h; for boiler feedwater.

Slurry Pumps (e.g., KRT Series):Rubber-lined for mining, flow 50–1,500 m³/h, abrasion resistance via elastomer inserts.

A 2025 German wastewater project showcased KSB’s KRT pumps processing 1 million m³/year with 18% OPEX reduction, affirming their century-plus legacy.

Grundfos Holding A/S, founded in 1945 in Bjerringbro, Denmark, leads with a 9% share, producing 16 million pumps annually in 80 countries (Grundfos Impact Report, 2025). The family-owned firm’s DKK 30 billion (USD 4.4 billion) revenue stems from 10,000 employees and DKK 1.5 billion R&D, pioneering CRN vertical multistages with 93% efficiency via silicon carbide seals. Excelling in building services (35%), water supply (30%), and industry (20%), Grundfos handles viscosities to 500 cSt and temperatures -40°C to 140°C.

Grundfos’ 2025 sustainability milestone: Carbon-neutral operations by 2030, with pumps using 50% recycled plastics. Their iSOLUTIONS platform offers IoT connectivity, cutting energy 25% for end-users.

Circulator Pumps (e.g., Alpha2 Series):ECM motors for HVAC, flow 0.5–10 m³/h, heads 0–8 m; up to 80% energy savings.

End-Suction Pumps (e.g., NB Series):Cast iron, flow 1–300 m³/h, heads 5–50 m; ISO 5199 compliant.

Submersible Pumps (e.g., SP Series):Stainless steel for groundwater, depths to 500 m, flow 0.5–400 m³/h.

Booster Systems (e.g., Hydro MPC Series):Modular for pressure, up to 1,000 m head; VFD-integrated.

Grundfos’ deployment in a Danish district heating network saved 22% energy in 2025, processing 5 million m³ annually—highlighting their global footprint.

Xylem Inc., spun off from ITT in 2011 and based in Washington, D.C., USA, holds 6% share with 500,000+ units/year across 150 countries (Xylem 2025 Report). With 23,000 employees and USD 7.4 billion revenue, Xylem’s USD 300 million R&D yields Flygt N-Series submersibles, achieving 95% uptime in 15% solids sewage via self-cleaning impellers. Focused on water tech (50%), wastewater (30%), and analytics (20%), Xylem’s pumps reach flows 10–5,000 m³/h.

Xylem’s 2025 ESG goals include 100% recycled water in ops, with pumps featuring low-friction coatings for 20% less power draw. Their global labs ensure NSF/ANSI 61 certification.

Submersible Sewage Pumps (e.g., Flygt N-Technology):Flow 5–200 l/s, heads 5–40 m; solids handling 65 mm.

Vertical Turbine Pumps (e.g., A-C Series):For irrigation, heads 10–300 m, efficiencies 90%; API 610.

End-Suction Centrifugals (e.g., e-803 Series):Flow 50–1,000 m³/h, cast iron/bronze; for water transfer.

Peristaltic Pumps (e.g., Quattro): Hose-based, flow 0.001–100 l/h; chemical dosing.

Xylem’s 2025 Indian wastewater plant upgrade handled 2 million m³/day with 25% efficiency gains, solidifying their innovation leadership.

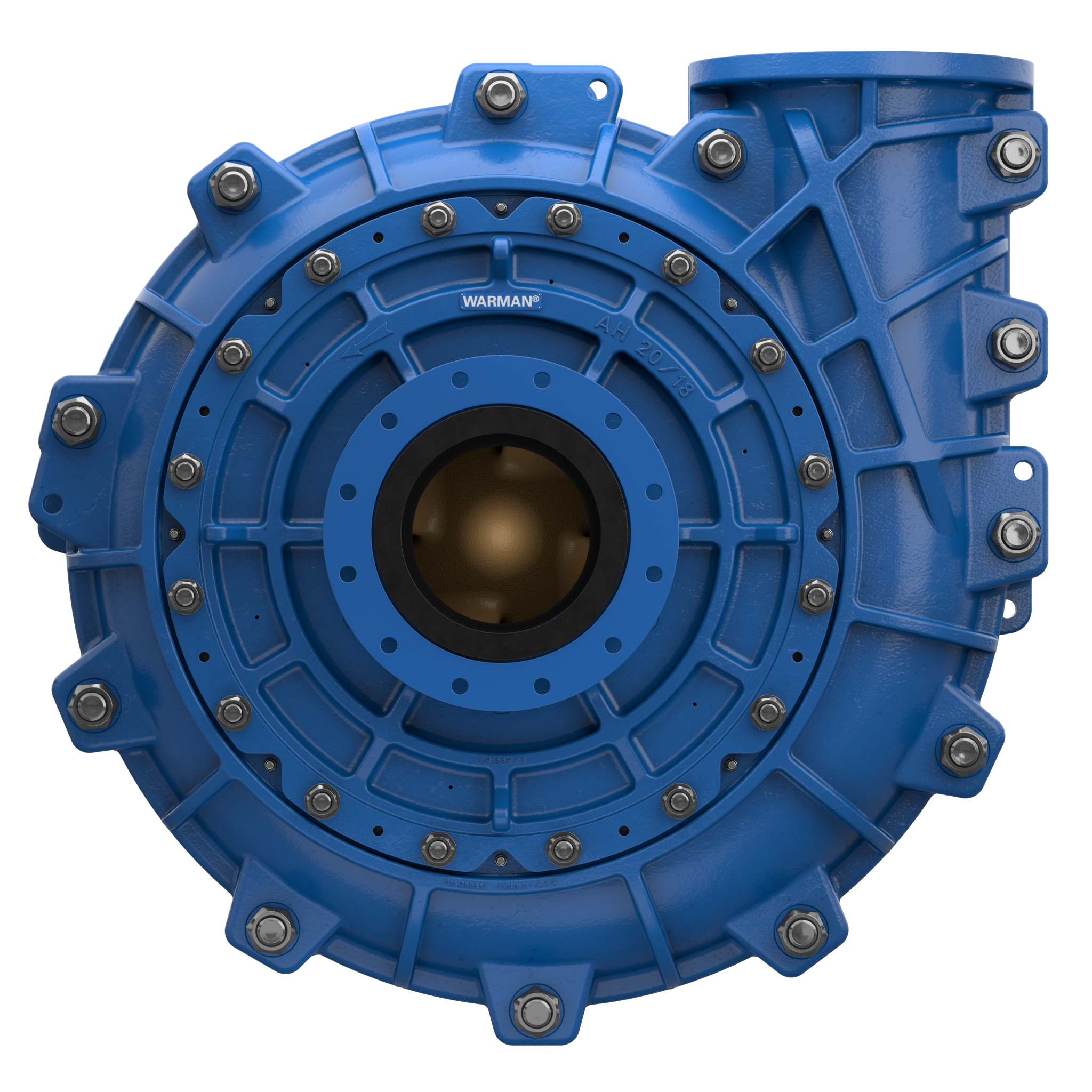

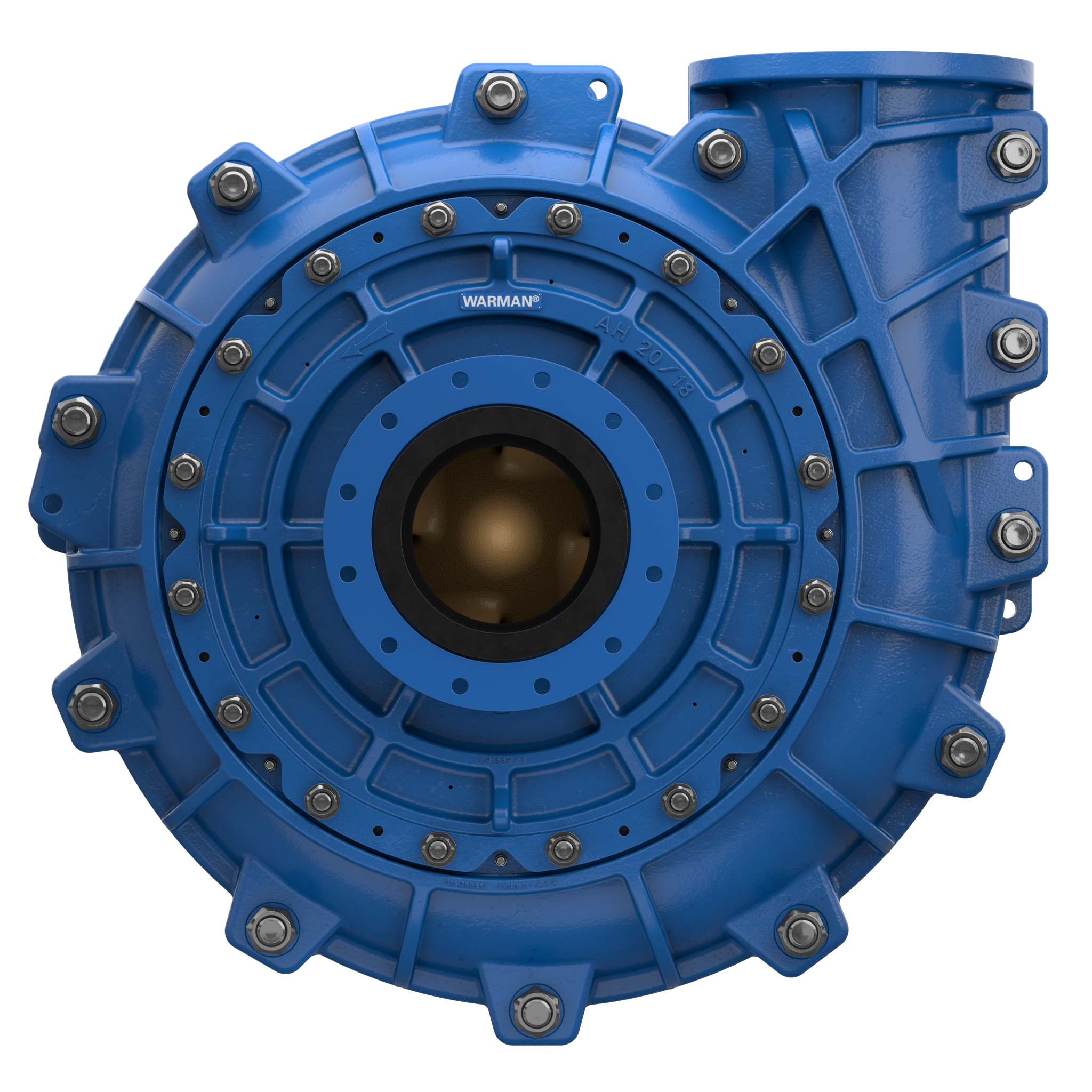

The Weir Group PLC, founded in 1871 in Glasgow, Scotland, UK, boasts 5% share with 600,000 units/year (Weir Annual Report, 2025). Employing 12,000 in 40 countries, Weir’s GBP 3 billion (USD 3.8 billion) revenue drives mining-focused pumps like Trio jaw crushers-integrated units, with 88% efficiency via adjustable vanes. Dominant in mining (50%), oil/gas (25%), and power (15%), Weir handles abrasives up to 60% solids.

Weir’s 2025 net-zero roadmap includes 40% renewable energy, with pumps using ceramic liners for 30% wear reduction. Their ESCO service model guarantees 15% productivity boosts.

Slurry Pumps (e.g., Warman Series):Flow 100–5,000 m³/h, heads 20–100 m; rubber/metal linings for tailings.

Centrifugal Pumps (e.g., Lewis HPX):High-pressure, 50–2,000 m³/h, up to 150 bar; for dewatering.

Progressive Cavity Pumps (e.g., Nova Rotor):For viscous slurries (1,000–50,000 cSt), flow 0.1–500 m³/h.

Vertical Pumps (e.g., KSB Omega):Sump duty, heads 5–50 m; explosion-proof.

Weir’s Australian mine installation in 2025 processed 1.5 million tonnes/year, cutting water use 18%—epitomizing their engineering heritage.

ITT Inc., via its Goulds Pumps division founded in 1848 in Seneca Falls, New York, USA, secures 4% share with 800,000 units/year (ITT 2025 Filings). With 10,000 employees and USD 3.9 billion revenue, ITT’s USD 200 million R&D crafts 3196 i-Frame pumps with ETFE linings for corrosive duty (pH 0–14). Leading in chemicals (40%), mining (30%), and power (20%), ITT’s portfolio covers flows 1–3,000 m³/h.

ITT’s 2025 circular economy initiative recycles 35% materials, with pumps featuring Vanton thermoplastic for 25% chemical resistance gains. Global centers offer 72-hour repairs.

ANSI Process Pumps (e.g., 3196 Series):Flow 5–1,500 m³/h, heads 10–150 m; efficiencies 80–88%.

Vertical Inline Pumps (e.g., VIC Series):Compact, flow 10–500 m³/h; space-saving for HVAC.

Slurry Pumps (e.g., SRL Series):For 40% solids, abrasion-resistant; flow 50–800 m³/h.

Multistage Pumps (e.g., 3910 Series):Heads to 300 m, for boiler feed; API 685.

ITT’s 2025 chemical plant upgrade in Texas boosted throughput 22%, handling 500,000 m³/year reliably.

EBARA Corporation, established in 1912 in Tokyo, Japan, commands 5% share with 700,000 units/year (EBARA 2025 Report). Employing 18,000 across Asia-Pacific and beyond, EBARA’s JPY 800 billion (USD 5.3 billion) revenue powers energy-efficient pumps like the EVM series (91% efficiency). Strong in semiconductors (30%), water (25%), and chemicals (20%), EBARA manages viscosities to 1,000 cSt.

EBARA’s 2025 green bond issuance funds 50% solar-powered factories, with pumps using low-vibration designs (under 2 mm/s). Their service network spans 100 countries.

End-Suction Centrifugals (e.g., EVM Series):Flow 10–1,000 m³/h, heads 5–80 m; inverter-ready.

Vertical Multistage (e.g., EEA Series):Pressures to 160 bar, for RO systems; compact footprint.

Submersible Pumps (e.g., KRT Series):Sewage duty, solids 50 mm; IP68 rated.

Cryogenic Pumps (e.g., L Series):For LNG, flows 100–2,000 m³/h; -196°C tolerance.

EBARA’s Japanese desalination project in 2025 treated 200,000 m³/day with 20% energy savings, showcasing their tech prowess.

Wilo SE, founded in 1872 in Dortmund, Germany, holds 4% share with 9 million units/year (Wilo 2025 Report). Family-controlled with 10,000 employees in 60 countries, Wilo’s EUR 1.8 billion (USD 2 billion) revenue emphasizes smart pumps like the Stratos MAXO (93% efficiency via ECM motors). Leading in building services (40%), water management (30%), and industry (20%), Wilo excels in heads 1–100 m.

Wilo’s 2025 digital factory initiative integrates AI for 25% defect reduction, with pumps using 60% recycled composites. Their app-based monitoring cuts service calls 30%.

Circulators (e.g., Stratos MAXO):Flow 1–10 m³/h, heads 0–18 m; Bluetooth control.

End-Suction Pumps (e.g., PX Series):Flow 5–200 m³/h; for irrigation.

Submersible Drainage (e.g., TWU Series):Solids 10 mm, depths 7 m; auto-start.

Booster Sets (e.g., SiBoost Smart):Modular, up to 300 m³/h; energy-optimized.

Wilo’s European smart city rollout in 2025 managed 1 million m³/year with 18% OPEX drop.

Taian OCEAN Pump Co., Ltd., founded in 1997 in Taian, Shandong, China, emerges as a dynamic force in industrial pumps, specializing in slurry and dredging solutions with a 15,000 m² ISO 9001/14001-certified facility producing 2,000+ units annually for 60+ countries (OCEAN Pump Company Profile, 2025). Employing 30+ experts, OCEAN Pump’s focus on heavy-duty submersibles like the ZJQ series—handling 60% solids at 2,000 m³/h—positions it as a go-to for mining and environmental applications, exporting to Indonesia, South Africa, and the Philippines with 98% on-time delivery.

OCEAN Pump’s 2025 innovations include agitator-enhanced designs for 25% better extraction in silty conditions, backed by USD 2 million R&D. Their high-chrome (Cr26–28%) impellers yield 20% longer life, aligning with global sustainability via low-emission diesel options.

Submersible Slurry Pumps (e.g., ZJQ Series):Flow 50–2,000 m³/h, heads 10–60 m; solids 60%, power 15–315 kW; for dredging.

Sand Dredging Pumps (e.g., OSE Series):Centrifugal, 100–1,500 m³/h, abrasion-resistant; 75% efficiency.

Gravel Pumps (e.g., OPG Series):For 50 mm particles, flow 200–800 m³/h; Hardox-lined.

Jet Suction Dredgers:Portable units, 100–500 m³/h; customizable pipelines to 1,000 m.

OCEAN Pump’s Jakarta port project in 2025 dredged 500,000 m³ with 20% efficiency gains, underscoring their rising global stature.

Taian HAICHUAN Pump Co., Ltd., established in 2005 in Taian, Shandong, China, is a rising star in submersible and slurry pumps, operating a 15,000 m² ISO-certified plant yielding 8,000 units/year for 40+ countries including Malaysia and South Africa (HAICHUAN Company Overview, 2025). With 30+ engineers, HAICHUAN’s USD 5 million R&D crafts ZJQ/DMS series pumps with 2–3 mechanical seals for 98% leak-free operation, handling 50–60% solids at flows up to 1,000 m³/h—ideal for construction and wastewater.

HAICHUAN’s 2025 expansions include VFD integration for 15% energy optimization and CNC machining for 95% precision. Their eco-focus: 30% recycled alloys, supporting global regs like REACH.

Submersible Sludge Pumps (e.g., DMS Series):Flow 50–1,000 m³/h, heads 10–40 m; solids 50%, IP68; for mining.

Heavy-Duty Dredge Pumps (e.g., ZJQ Series):Power 11–160 kW, abrasion via Cr27; 85% efficiency.

Sewage Pumps (e.g., WQ Series):Vortex impellers, solids 80 mm; auto-coupling.

Booster Pumps (e.g., Custom Sets):Modular, up to 500 m³/h; for dewatering.

HAICHUAN’s South African tailings pond in 2025 processed 300,000 m³ with 18% cost savings, marking their ascent in durable solutions.

The top 10 global industrial pump manufacturers of 2025—from Flowserve’s flow mastery to OCEAN Pump’s dredging dynamism—collectively drive a USD 91.8 billion market toward unprecedented efficiency and sustainability. With innovations like 93% efficient multistages, IoT-enabled monitoring (cutting failures 30%), and materials enduring 60% solids, these leaders address 2025’s challenges: rising energy costs (up 8%), stricter emissions (EU Green Deal), and infrastructure booms (global spend USD 9 trillion by 2030).

Key takeaways: Prioritize NPSH ratios under 3 m for cavitation-prone apps, VFD compatibility for 20% savings, and global service for 98% uptime. Chinese trailblazers like Taian OCEAN Pump and HAICHUAN offer cost-effective scalability (15–30% lower than Western peers) without compromising quality, ideal for emerging markets. As the sector eyes 5.2% CAGR, investing in these manufacturers yields 15–25% ROI through reduced OPEX and extended MTBF.

Bookmark

Daniel Féau processes personal data in order to optimise communication with our sales leads, our future clients and our established clients.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.