To fully understand the market’s current situation, it is important to put in context its evolution over the past two years.

Since the end of 2022, a series of factors and events, albeit exogenous, have significantly affected real estate markets across the globe.

Among these, at home, a sharp rise in interest rates at the end of 2022, followed by the political context following the dissolution of the French government. Abroad, the geopolitical context resulting from developments in the war in Ukraine, and more recently measures undertaken by Donald Trump. All have had a significant impact on volumes and prices. Markets in most countries have been significantly affected, and particularly in the United States.

Here, in France, statistics from the Chamber of Notaries show a 43% drop in the number of sales in Paris at prices in excess of 1 million euro between 2022 and 2024.

Over the past two years, however, our agencies in Paris have not witnessed this decline at all; in fact our sales have evolved significantly more favorably than the rest of the market.

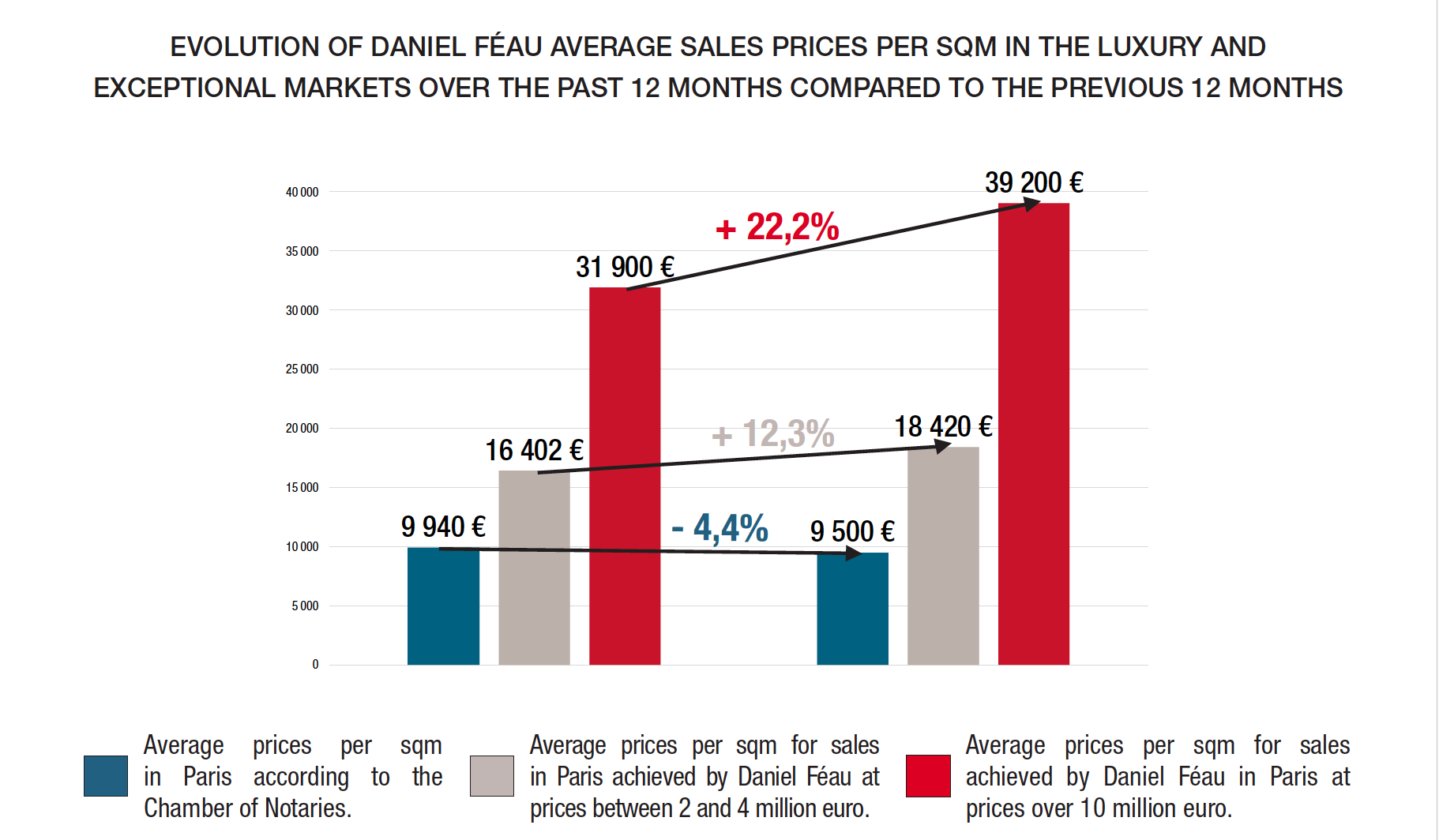

Similarly, when comparing the average prices in the capital recorded by the Chamber of Notaries with those of actual sales concluded by our agencies, a very different trend appears. A difference that is even more pronounced if we look at the prices of apartments sold by our agencies at prices between 2 and 4 million euro, and more so yet again at prices above 10 million euro.

Note that the average price per sqm for our sales at prices between 2 and 4 million euro is almost twice the average Parisian price as recorded in the Chamber of Notaries’ statistics. The most expensive recent sale per sqm concluded by Daniel Féau was 49,240€/sqm for a private mansion (photo below).

Based on the Chamber of Notaries’ Parisian sales database, in 2024 our Daniel Féau agencies achieved 27.3% of all sales in Paris at prices in excess of 4 million euro (i.e. 1.10 billion €). Our observations may therefore be considered to mirror statistics, and reveal the true state of the market for high-end and luxury assets.

We also noted at the beginning of 2025 that our daily stock of properties for sale had declined, after having steadily increased over the past two years. For the first time since the market correction began at the end of 2022, our agencies have been selling faster than new mandates have been coming in.

It’s no coincidence that in notably the capital’s 6th and 7th Districts, the Marais, and the "Golden Triangle" around Avenue Montaigne, neighbourhoods that are popular with wealthy French and international clients, our agencies are achieving strong sales.

Data from the Christie’s International Real Estate network allows us to observe that Paris continues to be the world’s leading capital city to attract UHNWIs*. The latter can be extremely demanding, but when we present them with the property that offers all they need and desire, it’s more or less a done deal.

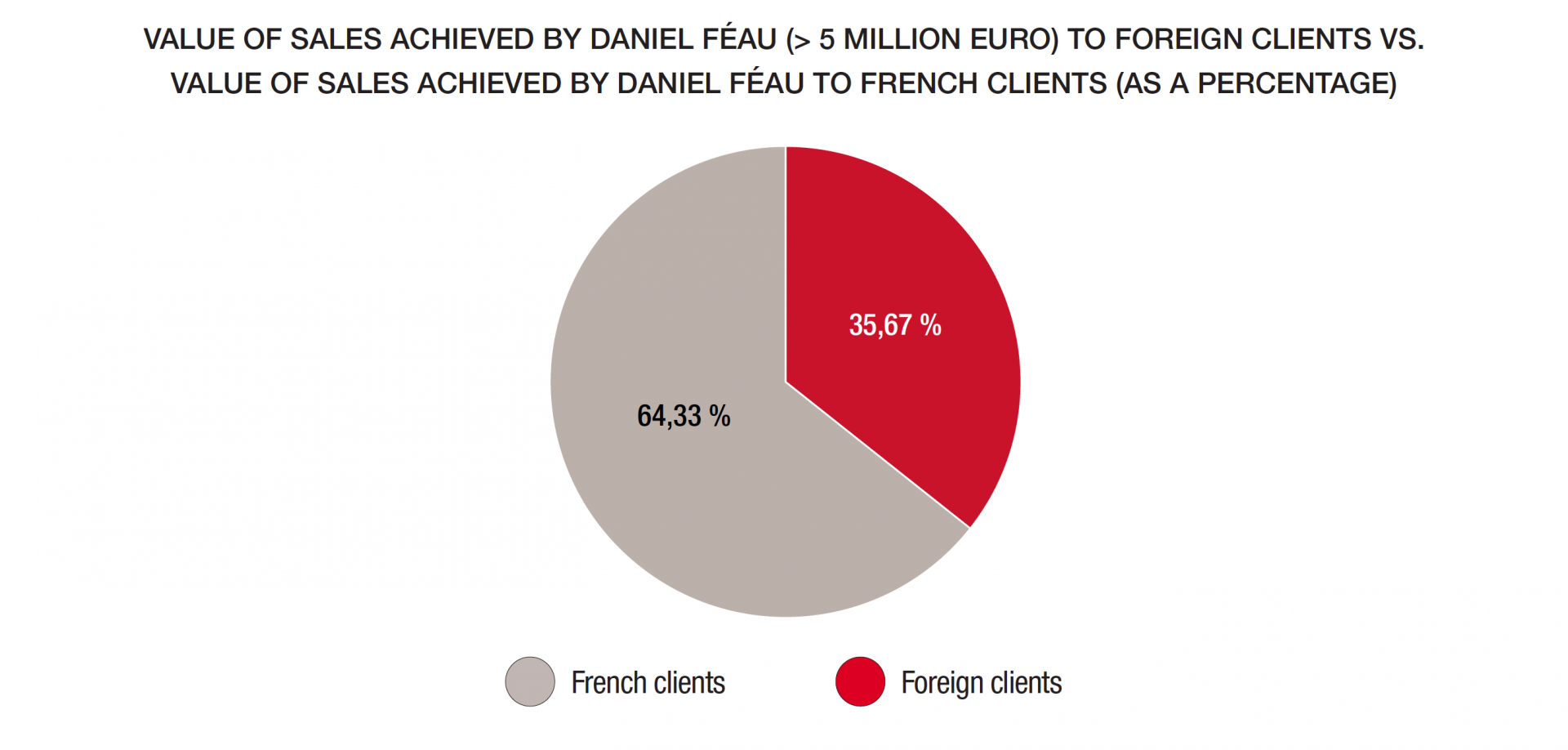

Americans, who have always represented the majority of our foreign buyers—nearly 34% over recent months, followed by buyers from the Arabian Gulf and Asia—have been particularly active since the beginning of the year.

It was an American who recently acquired for 20 million euro an artist’s studio which was once home to an early 20th century French painter, and whose works are in fact more keenly sought-after by collectors in the United States than they are in his home country.

The presence of this American clientele, with a strong attachment to Paris and particularly the cultural and artistic past of iconic Saint-Germain-des-Prés, has increased over recent months.

There is no doubt a «Trump» effect.

We are even seeing, for the first time, Americans on the West Coast traumatized by the recent massive wildfires and convinced that climate change will continue to provoke disasters in California and neighbouring states. With this in mind, France is becoming for many a safer option.

Buyers from the Gulf tend to target truly exceptional properties. It was the Crown Prince of the Kingdom of Saudi Arabia who purchased from us what is probably the world’s most expensive residential property, in Louveciennes, for the modest sum of 275 million euro (photo below).

However, our agencies located in more family-oriented districts or municipalities which attract French buyers seeking to acquire properties at prices between 1.5 and 2.5 million euro are not far behind, as proven by the results of our agencies in the capital’s 5th and 17th Districts, as well as in the 16th District’s Auteuil neighbourhood, for example.

Also noteworthy is the strong performance of our agency in the capital’s 9th District, clearly reflecting the gentrification of this once somewhat less desirable neighbourhood. And in the inner western suburbs, by the end of May our agencies in Boulogne and Saint-Cloud also witnessed significant growth compared to the last two years.

Daniel Féau Neuilly—which in 2024 achieved over 50% of sales in this desirable western suburb at prices in excess of 4 million euro—also started the year very well.

Our Versailles agency doubled its revenue compared to the previous 12 months, and our recently opened agency in Saint-Germain-en-Laye has got off to a flying start.

In conclusion, the turnover of our agencies in Paris and its desirable western suburbs demonstrates the resilience of not only the luxury market but also the family apartment market, whereas the trend is somewhat more wait-and-see in other segments of the market.

In the provinces, after a somewhat uncertain start to the year, our agencies in Provence and the Côte d’Azur are seeing their market pick up, with a significantly more dynamic second quarter.

We have recently concluded some significant sales, such as a 16th-century farmhouse set in over 10 hectares of olive groves near the centre of Saint-Rémy-de-Provence, sold for over 3 million euro, or a renovated private mansion in Arles.

In Saint-Tropez, French buyers are acquiring properties in and around Ramatuelle, Croix-Valmer and Saint-Tropez. We have achieved several sales in Ramatuelle, including a delightful property near Pampelonne and another in the Gigaro neighbourhood.

Inland in the Var department (Fayence, Entrecasteaux, etc.), the peaceful countryside is particularly attractive to residents of Cannes and Monaco seeking to escape the hustle and bustle of the coast, as well as European clients (notably Belgians and Swiss) yearning for space and unspoilt nature. Aix-en-Provence remains popular, with 90% French buyers.

For sale - Lambesc - Price: 6,700,000€

945 sqm - 8 bedrooms

An 18th-century “Bastide” - Enclosed grounds comprising farmland, centennial trees, and recreational areas.

Prices in and around Deauville remain high and stable, according to our agency in Normandy’s world-famous seaside resort.

The luxury real estate market in Deauville in 2025 is characterized by strong demand and a good supply of quality properties. Buyers, mainly Parisians, are attracted by the delightful environment, the sea, and the resort’s infrastructure. In May, we sold a beautiful and tastefully renovated near 700 sqm property set in a 2,000 sqm garden in the heart of Deauville’s Golden Triangle.

For sale - Coudray-Rabut

396 sqm - 7 bedrooms

18th/19th century chateau - 5 hectares of gardens and meadows, with 20 hectares of fields under an agricultural lease

At the beginning of June, accepted offers and sales agreements signed in our agencies amount to 480 million euro in total which, added to our sales since the beginning of the year, confirms our strong position in the luxury real estate market.

* Ultra High Net Worth Individuals: Individuals with non-real estate assets exceeding $30 million.

Charles-Marie JOTTRAS

President

Daniel Féau & Belles demeures de France

Press Officer : Dominique CALMELS

Tel : 06 85 41 62 10

Email : domcalmels@gmail.com